Donald Trump ran his presidential campaign on a platform of putting America first, although he has continued to be rather ambiguous about what this will actually entail. However, with the passing of a recent tax reform bill in the senate, analysts and observers now have some indication of what his intentions are, and they seem to be pretty much what was widely expected.

image source: here

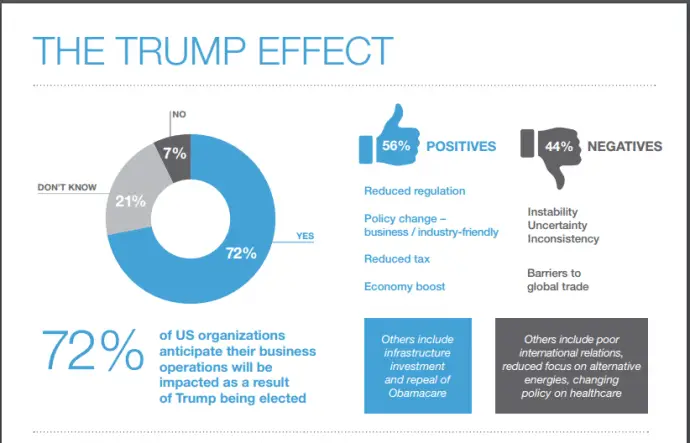

Throughout the campaign, and in the immediate aftermath of his electoral victory, many institutions were issuing stark warnings about the potential dangers that might be posed to the global economy should Trump follow through with many of the promises he made on the campaign trail. Fortunately, so far the worst of these predictions have not come to pass, but there is no doubt that the potential still exists for a major upset where the global economy is concerned as a result of the Trump presidency.

Renegotiating Trade

One of the central promises that Trump made while campaigning was that he would, at the first opportunity, seek to renegotiate a number of international deals. Plans were set out to renegotiate the Trans-Pacific Partnership, a significant trade deal that the United States was pursuing with the European Union, and the North American Free Trade Agreement (NAFTA).

The reaction to these proposals from around the world was mixed. Many saw NAFTA as a good trade deal, one that was beneficial to all involved, and the decision to seek to renegotiate it was widely seen as a misstep. On the other hand, the Trans-Pacific Partnership had always had a mixed reception amongst EU member states. Many feared that it would lead to a flood of American products which were not up to the high standards that the EU is known for.

Trump seems to believe that these tough renegotiations are necessary in order to stimulate the US economy and to bring back as many jobs to US soil as possible. Whether this is an accurate belief has been debated, but the consensus seems to be that Trump is promising more than he can deliver.

The complex issue of international trade deals is something you can learn about through an online political science masters, such as that offered by George Washington University.

Credit Rating

The tax reform bill which passed the senate on the 19th December is expected to add quite a considerable sum to the current national debt. Some estimates put the figure in the trillions of dollars, even the more conservative estimates point towards a large increase in debt and a potential threat to the US credit rating.

Countries who have close economic ties to the United States are particularly apprehensive about any large-scale changes in policy and philosophy. Among the countries who would be most affected by such changes are Canada, Mexico, Germany, China, and Japan. Trump has threatened to take a tough stance with China, although their influence in the increasingly precarious North Korea situation seems to be encouraging restraint.

Developing Countries

As the US moves away from globalization and free, open markets, in favor of a more isolationist approach, multinational corporations operating in developing countries are particularly at risk. They will have adopted strategies which assume free trade and an open flow of capital. Trump’s seeming disregard for climate legislation and environmental investments also looks like it might cause problems for developing countries as the rest of the world reassesses their approach to limiting fossil fuels.

The true impact of Trump’s presidency on the global economy will not become clear until at least next year. His failure to score any significant legislative victories has limited his options for pursuing changes.